Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

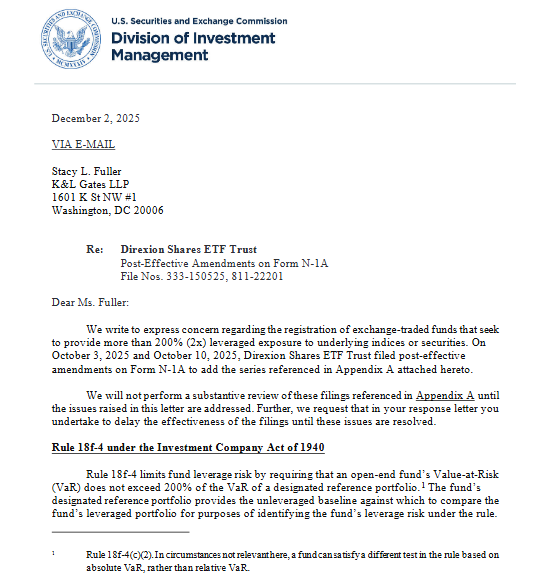

The U.S. Securities and Exchange Commission (SEC) has halted the approval process for multiple exchange-traded funds seeking to offer leverage exceeding 200%. In letters released Tuesday, the agency instructed issuers to either withdraw their filings or revise them to address risk-related concerns.

The notices, sent to firms, effectively pause the review of these products until the SEC’s questions are resolved. Regulators warned the proposals could expose investors to risks beyond what’s allowed for similar market-linked funds.

These ETFs aim to amplify the daily performance of equities, crypto assets, or commodities by using derivatives and complex trading strategies. The SEC cautioned that some of the benchmarks selected by issuers may not reflect the true volatility of the markets they intend to track, increasing the likelihood of outsized swings.

Leveraged ETFs experienced a boom during the pandemic, as short-term traders chased aggressive returns in turbulent markets. Assets invested in these products have climbed to roughly $162 billion, underscoring their growing popularity among speculative investors.

Despite rising demand, the SEC highlighted ongoing concerns about investor protection and potential systemic risks linked to extreme leverage. In a rare move, the SEC published nine nearly identical letters on the same day, an indication that the agency wanted to quickly signal its stance to fund issuers and the wider market.

Each letter offered fund managers a choice: withdraw the ETF applications or revise them to comply with the SEC’s risk thresholds. The regulator did not say whether it would reconsider revised proposals later.

The decision marks a shift from the SEC’s otherwise permissive attitude toward new ETF structures, including crypto-linked and other complex products. However, when it comes to high-risk leverage strategies, the agency appears to be taking a more conservative approach.

The asset managers involved have not issued public comments, and the SEC declined to discuss ongoing filings.

An experienced fintech marketer, now diving into Web3, crypto markets, and decentralized systems. Breaking down complex blockchain developments for accessible understanding.